Not long ago, Renesas electronics completed the acquisition of dialog, which is also a big event in the semiconductor industry. In fact, as early as February 8 this year, Renesas announced that it had reached an agreement with dialog to prepare for the acquisition.

In fact, in Renesas fy2020 Q4 quarterly report, Renesas mentioned the actual value of the acquisition. The acquisition of dialog is similar to the previous acquisition of INTERSIL and IDT in business logic: that is, it mainly complements the existing capabilities to form a more comprehensive solution.

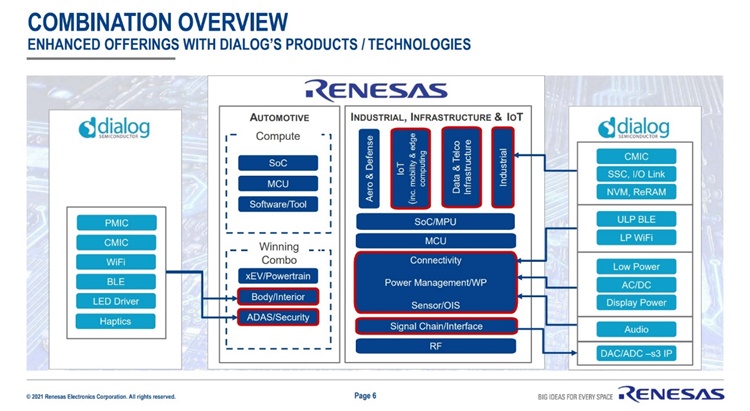

Renesas clearly explained the purpose of this acquisition in the financial report: 'around dialog's professional ability in low power consumption and mixed signal, the products provided by dialog include battery and power management, power conversion, CMIC (configurable mixed signal IC), LED drivers, customized mixed signal IC (ASIC) and automotive PMIC (power Management IC), wireless charging technology, etc.'

'In addition, dialog also provides a wide range of differentiated ble (low-power Bluetooth), WiFi and SOC, providing advanced connections for a large number of applications, including smart home, intelligent building automation, wearable, and connected medical. All these systems can complement and expand the company (Renesas Electronics) And provide comprehensive solutions to improve performance and efficiency in high-performance computing electronic systems. '

Let's take a brief look at the most direct benefits of dialog's acquisition for Renesas electronics.

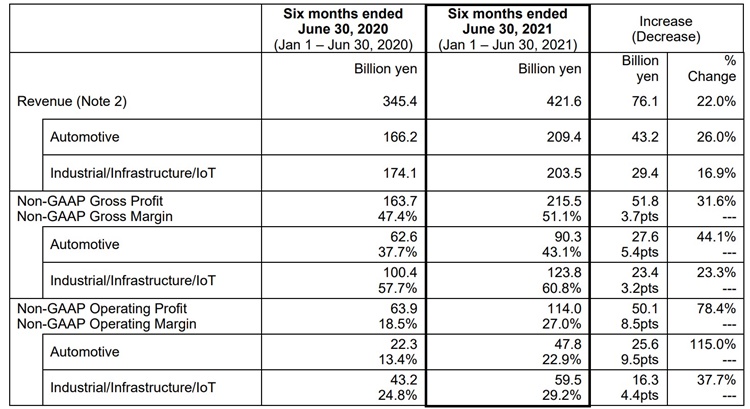

Improvement of revenue and profit

Last year, we summarized Renesas's MCU / SOC business and realized the logic of business growth:

1. Use sales and distribution strategies, combined product sales and winning combo to achieve rapid growth of revenue - because analog and power products have higher gross profit margin and promote profit growth; At the same time, analog semiconductor products have higher customer stickiness, which is a scheme to steadily drive the market share of MCU products;

2. Expand to more fields to prepare for potential growth.

Previously, after acquiring INTERSIL and IDT, Renesas quickly applied the combined product sales scheme to package different chips such as analog, power supply and digital into more complete solutions and sell them on the market. This product portfolio is called winning combo. The original INTERSIL and IDT products complement the coverage of Renesas products on the complete signal chain in a large framework.

In fact, this plan has effectively helped Renesas through the worst period of the industry from 2019 to 2020. Especially in the automobile business supported by Renesas business, the market fell sharply due to the early outbreak of covid-19. Last year and the year before last, we briefly analyzed the financial report and business performance of Renesas. Renesas's performance and the general development direction of the industry show a synchronous trend.

Looking at the financial report of Renesas in the first half of this year, the revenue growth of its businesses has been quite satisfactory, including automobile and industry / Infrastructure / IOT. In particular, it is worth mentioning that the gross margin grew at an amazing speed in the previous year. This is inseparable from the fact that the profit margin of analog and power products is much higher than that of digital chip products. Naturally, it is an important value brought by the acquisition of INTERSIL and IDT and the composition of winning combo portfolio products.

Not long ago, Renesas held a 'Renesas + dialog, a winning combination' media conference online. The meeting gave a relatively comprehensive introduction to the value of the acquisition of dialog for Renesas electronics and how to further complement the product capabilities. In fact, to sum up, it is to further improve the product layout of the existing Renesas, the original INTERSIL and the original IDT, including the combination and cross sales of winning combo and cross sales.

Dr. sailesh chittipeddi, executive vice president and head of the Internet of things and infrastructure division of Renesas Electronics Group, and Takeshi Kataoka, senior vice president and head of the automotive solutions division of Renesas Electronics Group, also confirmed the value of the acquisition of dialog for revenue and gross profit margin when answering reporters' questions.

In particular, Kataoka mentioned the strengthening of 'simulation' products. 'Previously, the acquisition of INTERSIL and IDT has increased the gross profit margin. Dialog's PMIC and CMIC products, especially high-value products, will undoubtedly increase our revenue.'

Synergistic effect

From a relatively intuitive point of view, the completion of the acquisition of dialog will inevitably change the business and personnel composition of Renesas electronics. For example, the vast majority (56%) of Renesas's R & D personnel were located in Japan; After the acquisition, the proportion of R & D personnel in Japan will be reduced to 46%; EMEA region will have a relatively large share of growth.

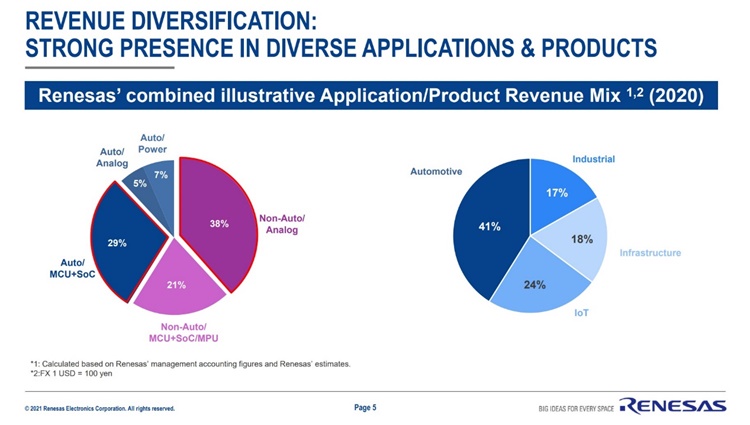

Further decentralization and diversification of business revenue composition is also inevitable. In the past, the revenue composition of Renesas Electronics was basically half of Abu (automobile) and iibu (industry / Infrastructure / IOT), and the share of the latter will be slightly larger. After the acquisition of dialog, iibu has been strengthened to a considerable extent. The pie chart on the left of the above figure divides the non automotive simulation and power products and the non automotive MCU + SoC / MPU product family - from this dimension, we can see the impact more clearly compared with the corresponding automotive simulation, power and MCU + SoC / MPU.

The expected synergies after the acquisition are shown in the left histogram in the figure above. Sailesh said that this is a conservative estimate, and the cost synergies here are considered in a minimized manner. SG & A is the largest component of cost synergy, including enterprise expenditure reduction, outsourcing cost reduction and organizational structure optimization. EDA software authorization and support related to R & D have corresponding scale effect; In addition, there is the bonus brought by the project priority, 'we will certainly use the R & D team to maximize the range.'

The most important natural is the synergy of revenue, which is expected to be $200 million. It is worth mentioning that in iibu business, revenue synergy mainly comes from the expansion of new customers, including greater sales force and channels provided by Renesas.

From the perspective of cross selling, it is also mentioned that the iibu field will increase CMIC, nonvolatile storage, low-power Bluetooth, WiFi, low-power PMIC, capdiv (capacitive voltage divider), audio capability, etc. On the wining combo side, the original MCU, MPU and sensor of Renesas are combined with WiFi, ble, external nonvolatile storage and low-power buck boost IP.

Related to Abu automobile business, cross selling is related to car body, ADAS and xev. Dialog is used as the product portfolio to strengthen. Winning combo is specific to Renesas's existing MCU, SOC and timing products.

In his summary, sailesh said: 'if we achieve the synergy goal, I will still be disappointed. Our goal is far beyond this expectation, especially in terms of revenue synergy.' 'what we show today is a good start, and it will be promoted to a new level in the future.'

About wining combo updates

Finally, let's take a look at some specific product level updates.

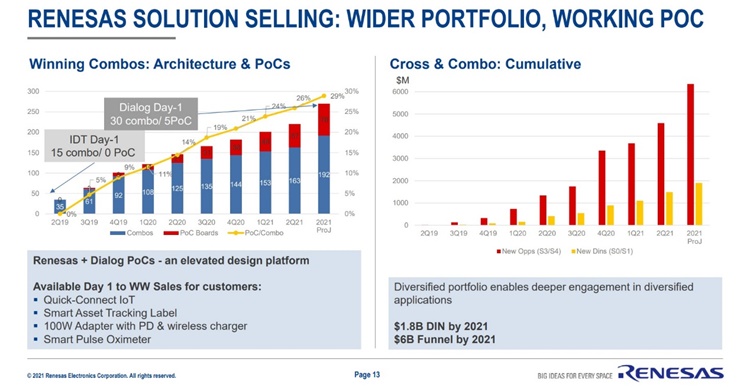

The following figure shows the general situation of wining combo after adding dialog. On the left is Abu and on the right is iibu. PMIC, CMIC, ble and WiFi used in Abu mentioned above are mainly used in vehicle body, interior decoration, ADAS, safety, etc; And iibu oriented CMIC, SSC (sensor signal conditioning), I / O link, low-power WiFi, AC / DC (dialog's well-known IP from S3), audio and other products are filled in at the corresponding level. Providing this integrated solution can make development easier and shorten time to market for customers.

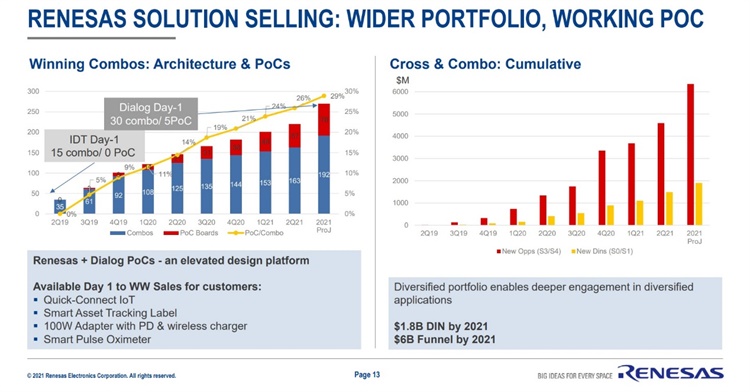

The specific product layout will not be expanded here. In the aspect of winning combo, some more specific data are presented, indicating that Renesas is moving very fast this time. In terms of iibu business, there are more than 30 combinations and 5 POC solutions on the first day (day-1). In contrast, on the first day of the original IDT acquisition, Renesas prepared 15 combinations without POC scheme.

The right part of this figure shows the changes in the number of opportunities (Opportunity Fund, red bar) and design in (orange bar) of cross sales and winning combo so far. The overall results are quite significant. The following figure shows some combination solutions that have been provided. Sailesh said that these solutions can speed up the time cycle for customers to develop products. At the same time, there will be 'hundreds of such system solutions' in the next 12-18 months.

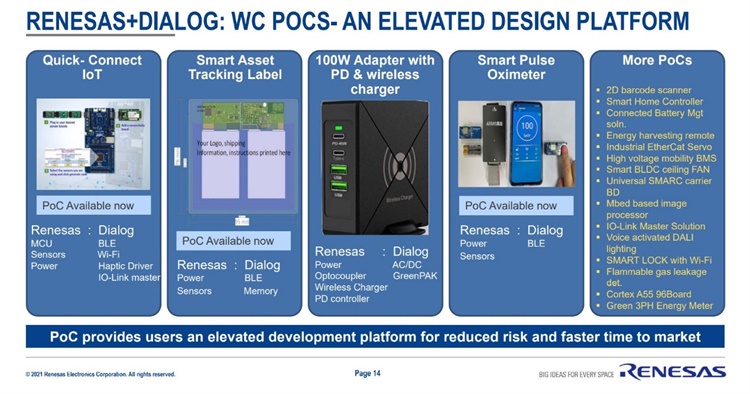

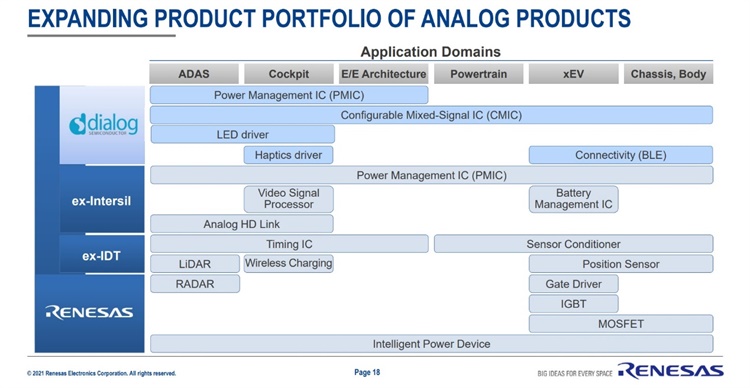

In terms of Abu business, dialog supplements Renesas products as shown in the figure above. This figure also lists the product layout of the original IDT and INTERSIL in Renesas Abu business; In terms of simulation products, it is more complementary to the original layout. It seems that Renesas made a lot of efforts in analog from the earliest digital chips to the acquisition of INTERSIL, IDT and now dialog. From the perspective of business and revenue, it is indeed a considerable promotion.

More specific examples will not be listed in this paper. In the examples cited by Renesas for Abu and iibu services, greenpak solutions are mentioned to integrate various mixed signal functions into one IC, which is a kind of scheme to reduce BOM cost and development time for downstream customers. Moreover, it is said that on day 1, Renesas has trained the sales team to make dialog shine in Renesas with faster action.

In response to reporters' questions, sailesh talked more specifically about the birth of greenpak solutions, including the training of application engineers, and then the training of other teams, including external teams, which may include customers. Greenpak solution itself first adopts 'state machine. For example, we develop one of the products together to realize the collaboration between tool chains, from it will move from a state machine based configuration to a microcontroller based configuration.' sailesh said.

Although we only mentioned a few words, this is the first time for us to understand how Renesas's winning combo was born from a more detailed level, which also confirms that it is not just a simple sales strategy.

Finally, it is worth mentioning that Renesas' acquisition of dialog will actually change the relationship between Renesas and its existing customers and suppliers. Sailesh also gave some simple examples in the interview. For example, in the past, it was necessary to cooperate with NOR flash suppliers, but now it will be replaced with dialog; In addition, ble, which originally had participants such as Nordic and silicon labs, will be replaced with dialog's internal solution in the future; And capdiv.

It seems that after the previous acquisition experience of INTERSIL and IDT, the acquisition of dialog is more familiar than in the past, both in terms of integration and in terms of the speed at which Renesas is actually transformed into productivity and value. From the most intuitive level, the results of the acquisition of dialog are expected to be reflected in Renesas's financial report soon. We are waiting to observe the changes.